pay outstanding excise tax massachusetts

The collector will send a demand which must be made more than one day after such excise becomes due. You need to pay the bill within 30 days of the date we issued the bill.

Online Payments Watertown Ma Official Website

2022 motor vehicle excise tax bills were mailed on Wednesday February 23 2022 for all vehicles registered in the Town of Plainville as of January 1 2022.

. An excise must be paid within 30 days of the issuance of the bill. Payments are due on Monday March 28 2022. Since 1981 the Massachusetts Registry of Motor Vehicles RMV calculates the value of vehicles for the excise tax at a rate of 25 per 1000 based on the value of the vehicle according to a depreciation schedule.

Click on Motor Vehicle Excise Tax if you want further information concerning Excise Tax. If your vehicle isnt registered youll have to pay personal property taxes on it. The excise tax rate in Massachusetts at the time of publication was 25 per 1000 of value.

The following steps for collection are set forth in MGL. Once the excise value is determined multiplying that amount by the tax rate determines how much tax the owner owes that year. 9 am4 pm Monday through Friday.

Percentages are determined as follows. Tax information for income tax purposes must be requested in writing. There is a 10 calendar day grace period for all current up to date taxes Motor Vehicle Excise Tax Pay current or outstanding bills.

To find out if you qualify call the Taxpayer Referral and Assistance Center at 617-635-4287. This can take up to 90 days. Toll-free in Massachusetts Call DOR Contact Toll-free in Massachusetts at 800 392-6089.

Boat Excise Tax Motor Vehicle Excise Tax Personal Property Tax Real Estate Tax WaterSewer Fees. Pay Delinquent Excise. The excise rate is 25 per 1000 of your vehicles value.

Excise abatements are warranted when a vehicle is sold traded or donated within the year or has been registered in another state. Any unpaid bill accrues interest at a rate of 12 per annum from the 31st day to the date of payment. Credit or Debit card payments will clear within 30 minutes.

Payment is due within 30 days from the day the excise tax bill was issued not mailed. Tax Department Call DOR Contact Tax Department at 617 887-6367. Electronic Check payments will clear in 2 weeks.

Municipal Building Ground Floor. The City of Fall Rivers Online Payments Center gives customers a convenient efficient and user-friendly way to pay bills online 24-hours a day 7-days a week. The value of a motor vehicle is determined by the Commissioner of Revenue based on the manufacturers list price MSRP.

MooringSlip Permit Waitlist Mooring Application. Excise Bills are issued numerous times throughout the year when received from the Registry of Motor Vehicles and are due 30-Days after the issue date. Make a Donation Miscellaneous Payment Training Uniforms and Equipment.

You can also use this system to pay for Municipal Lien Certificates. The excise tax rate is 25 per 1000 of assessed value. Massachusetts State law allows motor vehicle excise tax exemptions for vehicles owned by certain disabled people and veterans former prisoners of war and their surviving spouses and charitable organizations.

If your vehicle is registered in Massachusetts but garaged outside of Massachusetts the Commissioner of Revenue will bill the excise. Excise Bills Motor vehicle and boat excise bills are issued on a calendar year basis. You must file for abatement with the Athol Assessors office if you are entitled to abatement.

Residents who own motor vehicles have to pay taxes based on the value of their vehicles each year. Excise Tax is assessed at the rate of 2500 per thousand dollars of taxable value. You pay an excise instead of a personal property tax.

295 100 minimum Excise Tax Current Bills Only If you have received an abatement on a current bill please use the Excise Tax - Delinquent link below. Pay current and past due Real Estate Personal Property and Sewer. Real Estate Personal Property Motor Vehicle Excise Boat Excise Taxes and Public Utility payments are accepted.

Tax Year - choose year - 2023 2022 2021 2020 2019 2018 2017 2016 2015 2014 2013 2012 2011 2010 2009 2008 2007 2006 2005 2004 2003 2002 2001 2000 1999 1998 1997 1996 1995 1994 1993 1992 1991 1990 1989 1988 1987 1986 1985 1984 1983 1982 1981 1980 1979 1978 1977 1976 1975 1974 1973 1972 1971 1970. Please contact the Assessors office for abatement information at 978 249-3880. Motor Vehicle Excise.

The Registry of Motor Vehicles in Boston mails us the informational data on the. The rate of motor vehicle excise tax is 25 per 1000 of value and the tax is calculated from January 1 or the date of registration to the last day of the. The rate of the excise tax is 2500 per 1000 worth of value and the tax is calculated from the date of registration to the end of the calendar year.

We send you a bill in the mail. Call toll free 1-800-239-2155 Monday Friday 830 am. Motor vehicle excise bills are owed to the town where the vehicle was garaged as of January 1.

Online Payments Taxes Water Sewer Trash Parking Ticket Appeal Form. For Vehicles on the road January 1 that have paid an excise tax in the prior year those bills are generally issued by February 15. This information will lead you to The State.

Please enclose the coupons with your check and reference your bill number to ensure proper credit. The minimum excise tax bill is 5. Credit Debit Cards.

You must pay the excise tax bill in full by the due date. It is charged for a full calendar year and billed by the community where the vehicle is usually garaged. Contact Us Your one-stop connection to DOR.

Payment at this point must be made through our Deputy Collector Kelley Ryan Associates 508 473-9660. MassTaxConnect Log in to file and pay taxes. Motor vehicle excise tax is assessed and levied each calendar year for every motor vehicle that is registered in the Commonwealth of Massachusetts.

Condition and market value are not considered in determining value. How do I pay for overdue excise taxes that have been sent to Jeffery Jeffery for collections. How do I pay for overdue excise taxes that have been marked at the Registry of Motor Vehicles for non-renewal.

They also have multiple locations you can pay including. Massachusetts Motor Vehicle Excise Tax Information.

Massachusetts Sales Tax Small Business Guide Truic

Online Payments Watertown Ma Official Website

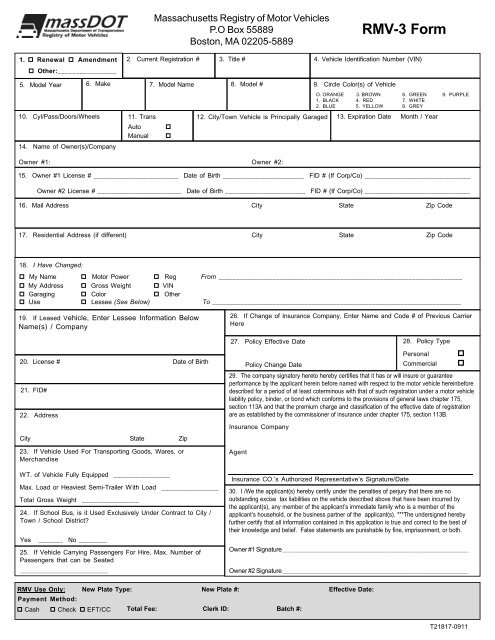

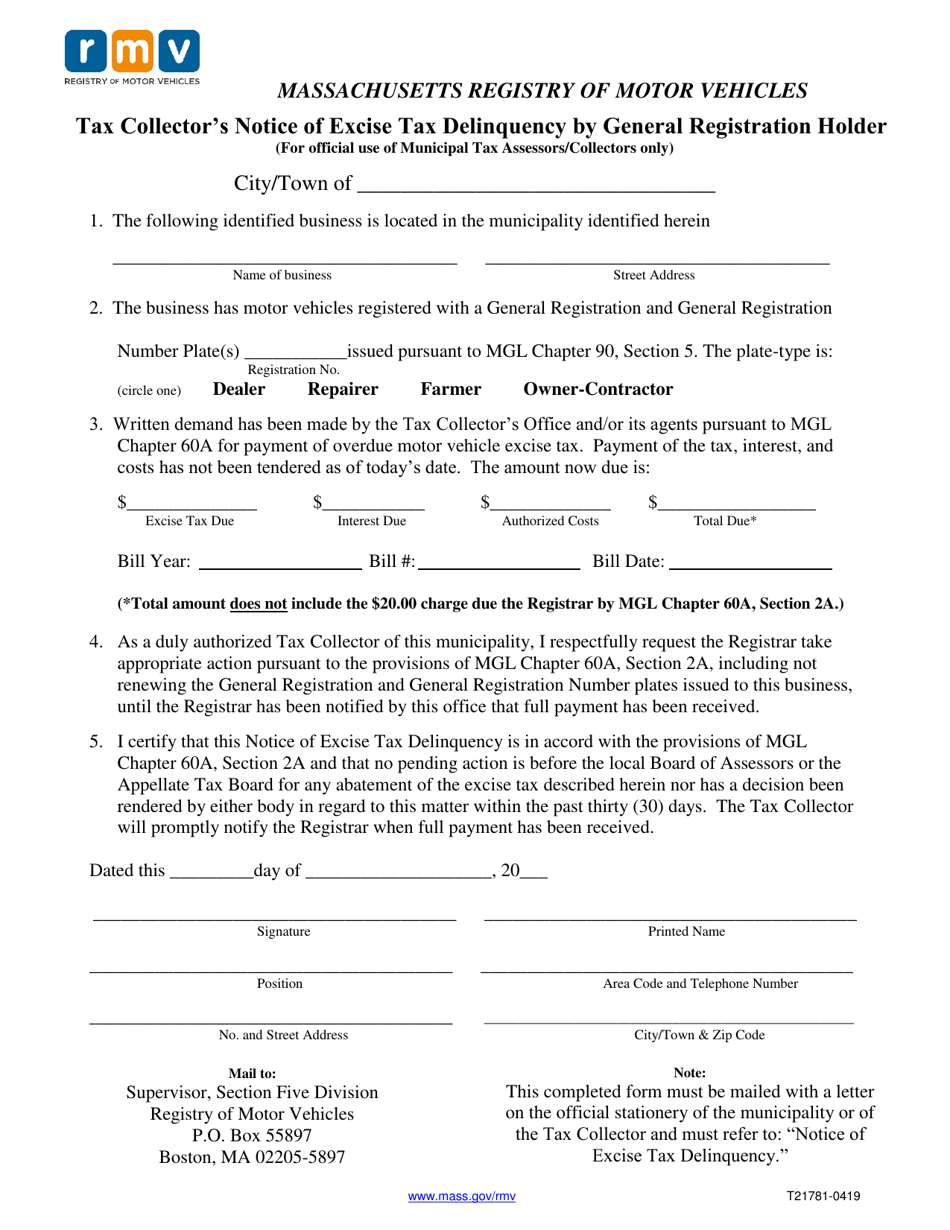

Form T21781 Download Printable Pdf Or Fill Online Tax Collector S Notice Of Excise Tax Delinquency By General Registration Holder For Official Use Of Municipal Tax Assessors Collectors Only Massachusetts Templateroller

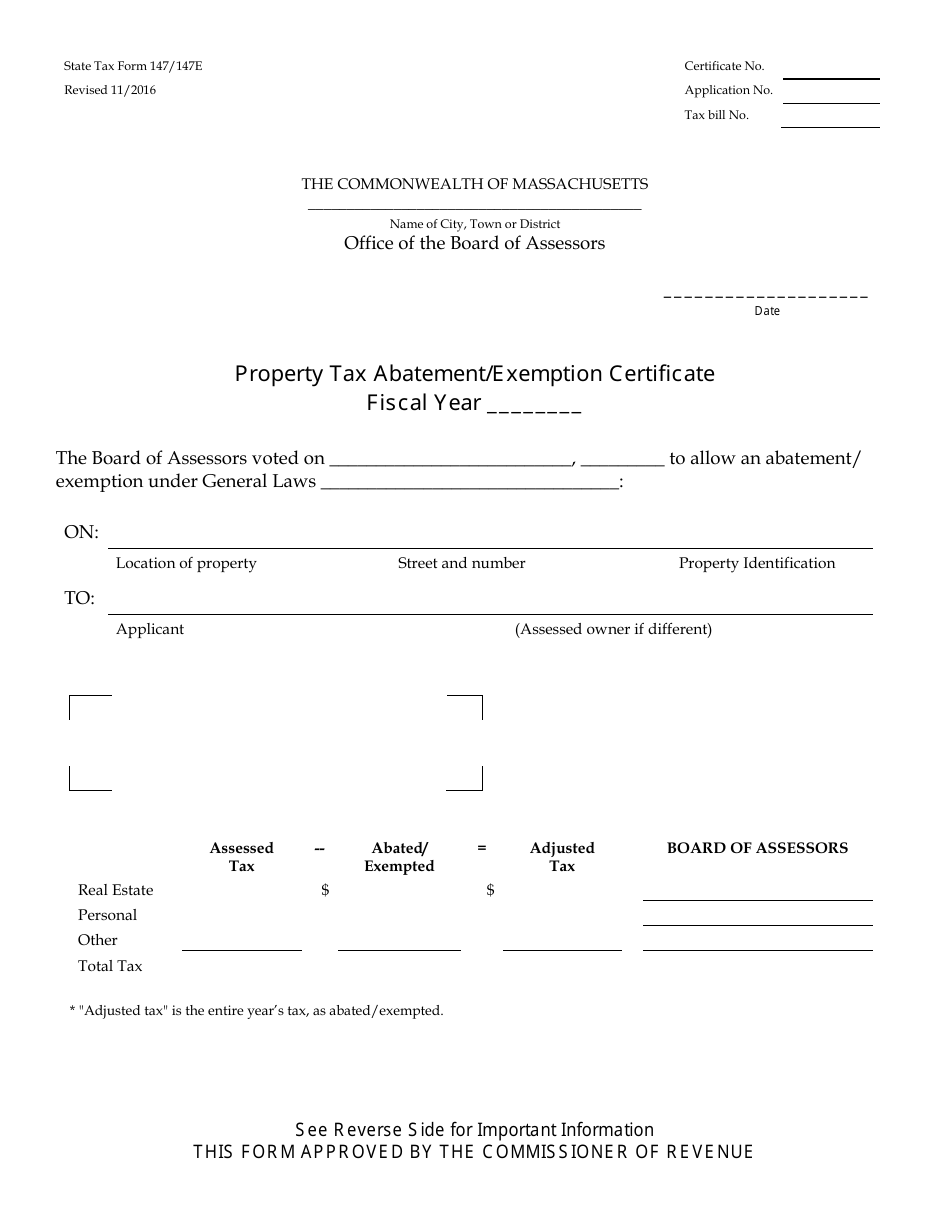

State Form 147 147e Download Fillable Pdf Or Fill Online Property Tax Abatement Exemption Certificate Massachusetts Templateroller

Excise Tax What It Is How It S Calculated

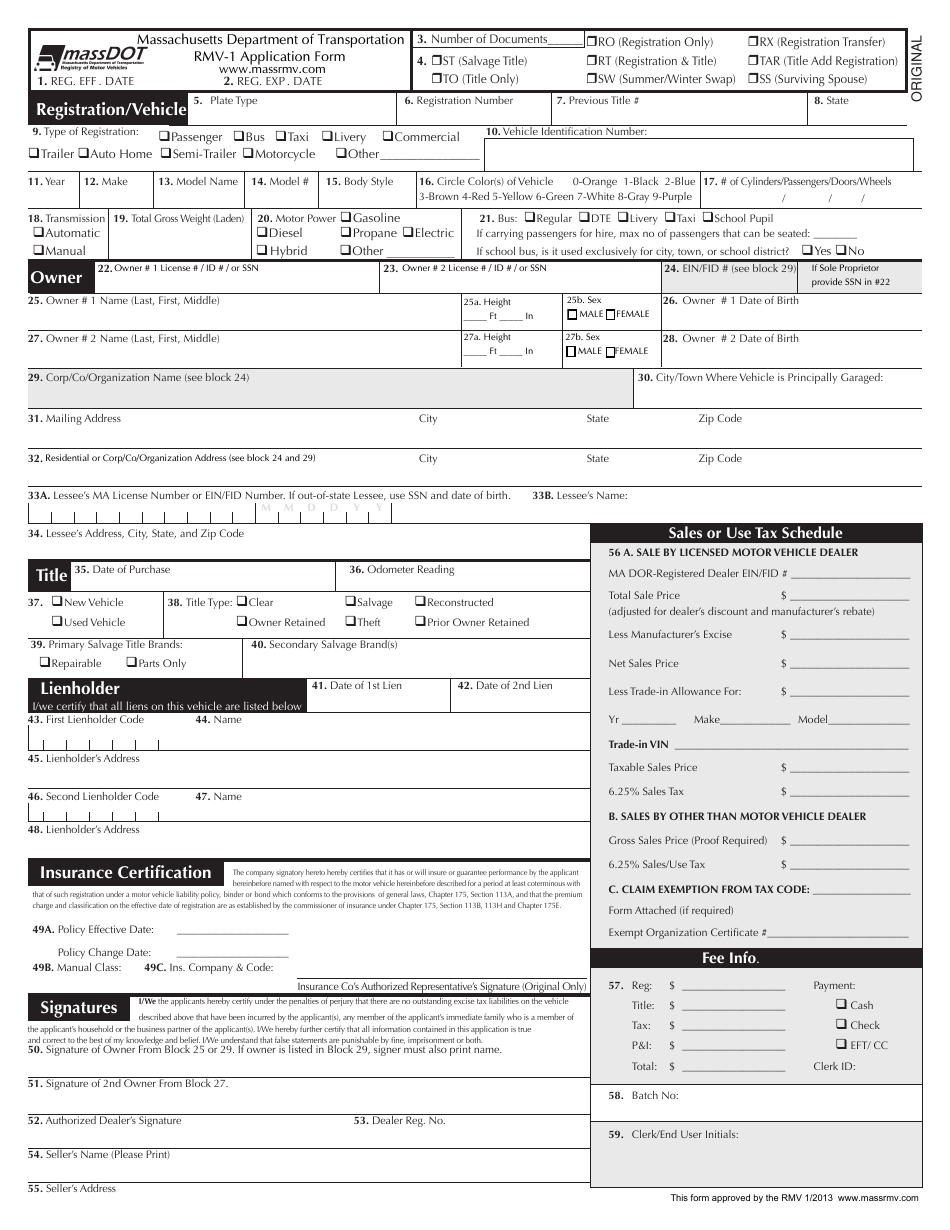

Form Rmv 1 Download Fillable Pdf Or Fill Online Application For Registration And Title Massachusetts Templateroller

Motor Vehicle Excise Tax Bills Leicester Ma

Massachusetts Rmv Announces Annual Low Plate Lottery Wwlp

Home Seller Closing Costs In Massachusetts Closing Costs How To Plan Good Faith Estimate

Dor Announces Updates To Offer In Compromise Program Opendor

Form 1 Nr Py Instructions Mass Gov

Download Instructions For Form Ttlreg100 Registration And Title Application Pdf Templateroller